Calculation Of Salary For Incomplete Month Of Work Malaysia

If you are a monthly rated full time employee and took unpaid leave for the month you should count it as an incomplete month of work to calculate your salary.

Calculation of salary for incomplete month of work malaysia. Calculation of yearly income tax for 2019. Smart mypay payroll malaysia and hr software by smart touch is a certified payroll software which fulfilled all the standards of payroll calculation set in malaysia like epf sosco pcb tax. We calculate how much your payroll will be after tax deductions in any region.

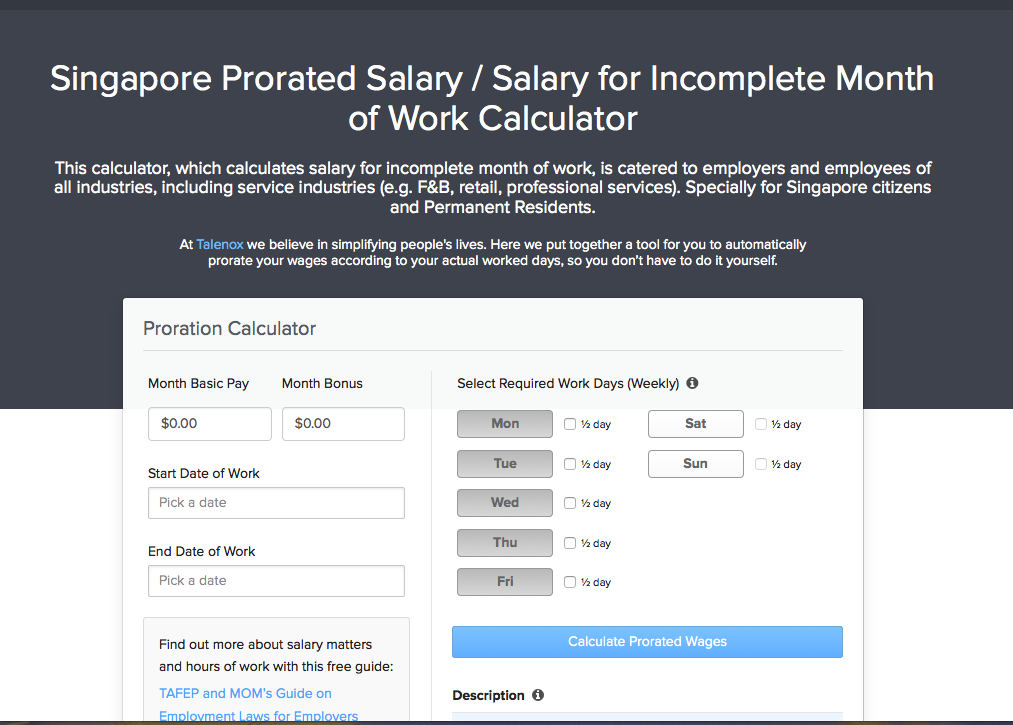

When an employee joins a company or ceases employment during a month thereby having an incomplete month of service the salary payment may have to be apportioned accordingly. This makes it easier for users to check salary calculator in details in a more neat and order manner in payroll malaysia. If you need to check total tax payable for 2019 just.

To calculate unpaid leave. Find the number of working days in the current month. Salary calculator malaysia.

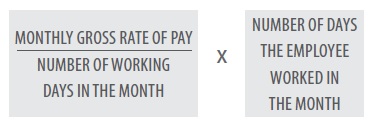

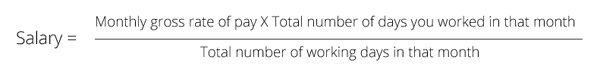

Half day when the number of hours worked in the day is 5 or less. Salary for an incomplete month of work is calculated as follows. Wages or salary payment subject to epf contribution.

There are salary definition several types of pay salary calculator malaysia periods such as pay for the end month bonus month mid month advance and other pay in payroll system. Use this figure to calculate how much the employee is paid daily monthly salary working days in month. Please visit our web site for more information.

Salary calculation for incomplete month. However the method of this method remains the same in hiring workers. Pcb epf socso eis and income tax calculator.

It does not include. One working day when the number of hours worked in the day is more than 5. Our data is based on 2020 tax tables from malaysia.

To manually calculate unpaid leave you would need to ensure that the record unpaid leave in payroll is not ticked under the settings payment settings. Find your net pay for any salary. Wages or salary payment subject to socso contribution 8.

Neuvoo online salary and tax calculator provides your income after tax if you work in malaysia. Per cent per month while the employees share of contribution rate will be zero per cent.